Losing a loved one is never easy, and dealing with inherited property on top of grief can feel like too much to handle. That’s especially true in Louisiana, where the Napoleonic Code sets us apart from other states. If you’ve just found yourself in charge of property after a family member passed, this guide is for you. We’ll talk in plain language and walk through the basics of community property, forced heirship, and even selling that inherited home—without turning it into a legal nightmare.

Table Of Contents

A) Louisiana’s Unique Inheritance Laws: and Why They Stand Out

1. Community Property vs. Separate Property In Louisiana

2. Usufruct Rights

3. Forced Heirship

B) How Inheritance Without A Will (Intestate) Works In Louisiana

1. Louisiana’s Order of Succession

2. A Step-by-Step Guide to Louisiana Succession Without a Will

C) How Inheritance WITH a Will (Testate Succession) Works in Louisiana

1. A Step-by-Step Guide to Louisiana Succession With a Will (Testate Succession)

D) Selling an Inherited Home in Louisiana

1. The Legal Process of Selling an Inherited Home in Louisiana

2. Do You Pay Taxes on Inherited Homes in Louisiana?

E) Need Help Selling Your Inherited Property in Louisiana?

Louisiana’s Unique Inheritance Laws: Why They Stand Out

Before we start laying out the inheritance process, it’s important for you to understand Louisiana’s unique inheritance laws. Blame—or thank—the Napoleonic Code. While the rest of the country uses common-law principles, Louisiana’s laws revolve around concepts like community property, usufruct, and forced heirship. Confused? Don’t worry; let’s break it down.

1. Community Property vs. Separate Property In Louisiana

Community Property: If you’re (or you were) married, anything acquired during the marriage is considered community property—this can be your family home, cars, or even some bank accounts. When one spouse passes, their half goes through something called succession.

Both spouses equally own community property, meaning that when one spouse dies, their half is inherited by their heirs (usually children), while the surviving spouse retains ownership of their half and may receive usufruct (the right to use the property until they pass away).

Separate Property: Separate Property: This covers anything owned before the marriage or received as an individual gift or inheritance. Unlike community property, it isn’t divided evenly between spouses.

When the spouse who owns the separate property passes away, that property generally follows the instructions in their will—or, if there’s no will, Louisiana’s laws of succession. Even then, a surviving spouse might have usufruct rights, meaning they can use and benefit from the property (like living in the house) without actually owning it.

2. Usufruct Rights

Usufruct is the right to use and benefit from property that belongs to someone else. It’s common for a surviving spouse to get a lifetime usufruct over a family home, even though the children (or other heirs) technically own it. The owners of the property would have to wait until the usufruct rights are terminated or the surviving spouse passes away until the property can be sold.

Who pays for the house during the period of usufruct rights? The surviving spouse is generally responsible for expenses like mortgage payments, insurance, utilities, and basic upkeep while they’re living on the property. Major repairs can sometimes be a shared responsibility, so it’s best to clarify these details in advance or consult with an attorney if questions arise.

3. Forced Heirship

This legal principle ensures that certain heirs—known as “forced heirs”—are guaranteed a portion of a deceased person’s estate despite what the will says. Forced heirship is a key part of Louisiana’s inheritance system, ensuring that younger or disabled family members are provided for.

So, who qualifies as a forced heir? In Louisiana, forced heirship applies in specific situations, including:

- Children under 24: If the deceased has a child who is 23 or younger at the time of their passing, that child is considered a forced heir. This rule applies even if the child is legally an adult (18+), reflecting Louisiana’s focus on supporting young adults as they transition to independence.

- Disabled children of any age: Children who are permanently unable to care for themselves due to a mental or physical disability are also protected under forced heirship laws. This includes conditions like severe disabilities or chronic illnesses.

- Grandchildren under 24 (in certain cases): If a child of the deceased has passed away and left behind a grandchild who is under 24, that grandchild may qualify as a forced heir, provided their parent (the deceased’s child) would have been under 24 or incapacitated at the time of the decedent’s death.

How Inheritance Without A Will (Intestate) Works In Louisiana

In Louisiana, a succession without a valid will is called an intestate succession, and it means Louisiana’s state laws—not the deceased’s wishes—determine how their property is divided. This can seem complicated, but understanding the basics can help can help you navigate the inheritance process with ease.

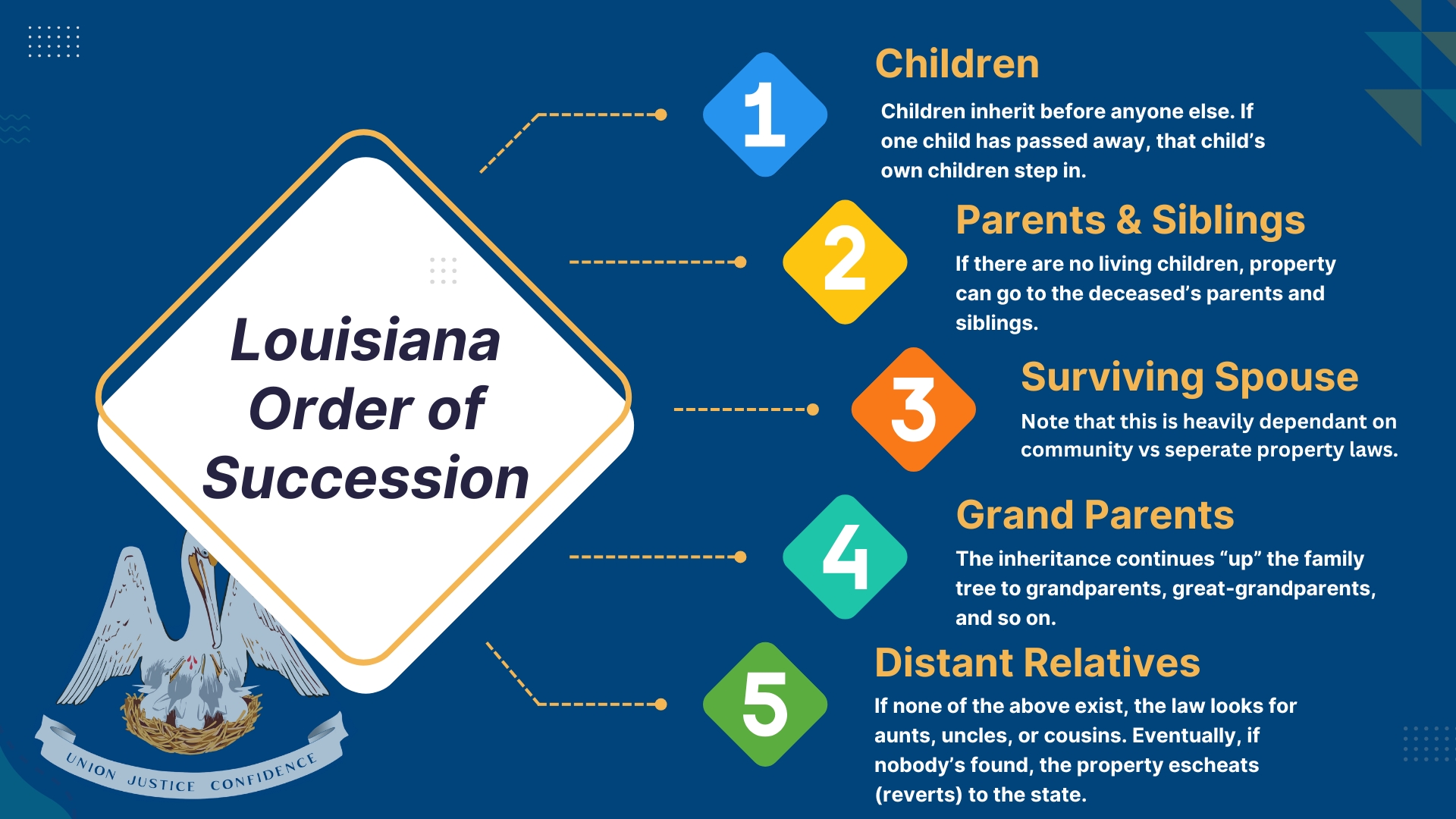

1. Louisiana’s Order of Succession

When a loved one passes away with no will, or the will is deemed invalid, the law decides who inherits:

- Kids (Descendants) First

- Children inherit before anyone else. If one child has passed away, that child’s own children step in.

- Parents & Siblings

- If there are no living children, the property can go to the deceased’s parents and siblings. Parents often get a lifetime usufruct, while siblings get “naked ownership.”

- Surviving Spouse

- For community property, the spouse keeps their own half and may get usufruct over the decedent’s half until certain conditions end (like remarriage). For separate property, it’s more complicated—sometimes it goes to the spouse, and sometimes it goes back up the family tree.

- Forced Heirs

- Never forget about forced heirship. If the deceased has minors (under 24) or permanently disabled children they are entitled to the inheritance.

- Going Up the Tree

- If none of the above exist, the law looks for grandparents, aunts, uncles, or cousins. Eventually, if nobody’s found, the property escheats (reverts) to the state.

2. A Step-by-Step Guide to Louisiana Succession Without a Will

Even though intestate succession might feel confusing, breaking it down into steps can make it more approachable. Here’s how the process generally unfolds:

- Gather Essential Documents

- Start by collecting the death certificate, property deeds, bank statements, and any other paperwork you can find. This will help confirm what assets exist and who might be entitled to them.

- Open Succession in Court

- File a petition at the district court in the parish where the deceased lived. This officially starts the process of identifying heirs and distributing the estate.

- If no one steps up, the court will appoint an administrator to handle everything. This person is responsible for collecting assets, paying bills, and making sure each heir receives the correct share.

- Inventory the Estate

- Next, the court (or an appointed notary or administrator) will make a list of everything the deceased owned. This includes real estate, bank accounts, personal items, and any debts owed.

- Being thorough here is crucial—missing assets can slow down or complicate the process later.

- Pay Debts and Taxes

- Before assets can be distributed, any valid debts—like mortgages, medical bills, or credit card balances—must be paid off from the estate.

- If there are tax obligations, those need to be handled, too. (Most people won’t face federal estate tax unless the estate is very large, but other taxes can still apply.)

- Distribute the Inheritance

- After all debts are satisfied, whatever remains is divided among the heirs according to Louisiana’s order of succession. Kids first, then parents and siblings, then spouses, and so on.

- Finalize and Close

- The administrator or appointed representative files a final account with the court, showing how everything was managed and distributed.

- Once the court approves, the intestate succession process is considered complete.

How Inheritance WITH a Will (Testate Succession) Works in Louisiana

1. A Step-by-Step Guide to Louisiana Succession With a Will (Testate Succession)

When there’s a valid will, it can simplify the inheritance process—but it doesn’t automatically become easy. Here’s how testate succession generally plays out:

- Locate and File the Will

- Wills might be stored with an attorney, in a safe deposit box, or tucked away in a personal file. Once found, the original will must be filed with the district court in the parish where the deceased lived.

- Executor Appointment

- Most wills name an executor—the person who will handle estate affairs. If the named executor can’t or won’t serve, the court appoints someone else to step in.

- Once recognized by the court, the executor receives official documentation (often called Letters Testamentary) confirming their authority to manage the estate.

- Notify Heirs and Creditors

- The executor is responsible for letting all beneficiaries (those named in the will) and potential creditors know about the succession. This might involve letters, emails, or placing notices in local newspapers.

- This step ensures everyone has a fair chance to claim what’s owed to them (like unpaid debts or inheritance shares).

- Inventory and Appraise the Estate

- The executor or a notary identifies and values all of the deceased’s assets—bank accounts, real estate, personal property—along with any outstanding debts or taxes.

- If the will includes specific bequests (like “my car goes to my nephew”), those items are noted separately.

- Pay Off Debts and Taxes

- Debts and taxes come first. The executor uses the estate’s funds to settle any valid claims before distributing inheritances to beneficiaries.

- If there isn’t enough money, some assets might have to be sold to cover these costs.

- Distribute Assets According to the Will

- Once all obligations are settled, the executor follows the will’s instructions for who gets what. This could mean transferring the title of a house, dividing up bank funds, or handing over personal heirlooms.

- Close the Estate

- The executor prepares a final accounting (a detailed report of every expense, distribution, and remaining asset).

- With court approval of this final accounting, the estate is officially closed, and the executor’s job ends.

Selling an Inherited Home in Louisiana

Inheriting a house is one thing—deciding what to do with it can be a whole other challenge. Maybe you don’t live nearby, or the place needs more repairs than you can handle. Here’s what to consider if you’re thinking about selling:

- Know Your Ownership Situation

- If there’s more than one heir, you all share ownership. Everybody typically needs to agree on selling, or the court can order a partition sale if there’s a major disagreement.

- Finish Succession First

- You can’t usually sell the home until it’s legally transferred from the deceased’s estate to the heirs. This often means the succession needs to be at least partly complete, so the title is clear.

- Check for Liens or Debts

- Make sure there aren’t any mortgages, liens, or unpaid property taxes attached to the home. These issues can delay—or even derail—a sale if they aren’t addressed.

- Consider an “As-Is” Sale

- If the property is in rough shape, selling “as-is” might be a good option. You won’t have to pour money into repairs, but you might not get top dollar, either.

- Hire the Right Help

- A real estate agent can handle the listing and negotiation process, or you might opt for a cash buyer to speed things up. Weigh the pros and cons of each route, especially if you need a quick sale.

The Legal Process of Selling an Inherited Home in Louisiana

Once you decide to sell, here’s how you’ll navigate the legal side:

- Clear the Title

- Even if you’ve gone through succession, make sure the house is officially in the heirs’ names. If it’s not, you’ll need to file the right documents (often a Judgment of Possession) to transfer the title from the estate to the living heirs.

- All Owners Must Sign

- If the home has multiple owners (siblings, cousins, etc.), everyone must sign the paperwork to sell. If someone refuses, the sale can’t go through unless a court orders a partition.

- Disclose Known Defects

- Louisiana requires sellers to disclose known issues with the property (like a failing roof or foundation problems). Failing to do so can lead to legal trouble later.

- Coordinate with Potential Buyers

- Once the title is clear and you’re ready to list, you or your realtor will show the home, negotiate offers, and eventually sign a purchase agreement. Be prepared to do a title search to confirm everything is on the up-and-up.

- Close the Deal

- On closing day, you and the buyer meet (often at a title company) to finalize the sale. Paperwork is signed, funds are transferred, and the keys change hands.

- After closing, the proceeds are typically split according to each heir’s share in the property.

Do You Pay Taxes on Inherited Homes in Louisiana?

Taxes can feel like the biggest wildcard in any inheritance scenario. Here’s what you need to know:

- Inheritance Tax? Not Anymore

- Good news: Louisiana no longer has a state inheritance tax. You don’t have to worry about an extra state-specific fee just because you inherited a house.

- Federal Estate Tax

- This only applies to very large estates (multi-million-dollar estates in most cases). If you’re dealing with a more modest property, federal estate tax likely won’t come into play.

- Capital Gains Tax

- If you sell the inherited home, you might owe capital gains tax on any profit above its value at the time of inheritance. However, you get a “step-up” in basis—meaning the starting value is usually what the property was worth when your loved one passed, which can significantly reduce or even eliminate capital gains.

- Property Taxes

- If you hold onto the home, you’ll need to stay on top of property taxes just like any homeowner. Make sure the tax records are updated to reflect the new owners (the heirs) after succession is complete.

Need Help Selling Your Inherited Property in Louisiana?

Dealing with inherited property can feel overwhelming, but taking it step by step helps. Here in Louisiana, Napoleonic Code rules on community property, forced heirship, and usufruct make our laws unique—but not impossible to handle.

- If there’s no will, follow intestate succession rules to figure out who gets what.

- If there is a will, remember that forced heirship could still affect how assets are divided.

- Selling an inherited home? Clear the title, settle debts, and ensure all heirs agree.

- Taxes are mostly about capital gains when you sell. Louisiana doesn’t have an inheritance tax anymore.

When in doubt, professional guidance—from attorneys, realtors, or financial advisors—can save time, money, and stress. The key is recognizing that you don’t have to do it alone. With the right help, you’ll be able to handle your loved one’s estate smoothly and focus on what truly matters: honoring their memory while moving forward in a way that’s best for you and your family.

If you need to sell inherited property quickly and easily, Bertucci Investment Group is your best option. Bertucci Investment Group buys inherited properties for cash. This means no dealing with a realtor, being able to close in as little as 7 days, and having someone to help guide you through every part of the succession process. Fill out the form below or call us at (504) 920-4747!